Hello everyone,

Half the year’s nearly gone, and with Q3 right around the corner, it’s the perfect time to pause and take stock of what Q2 set in motion. Founders are tightening their builds, AI is moving from side tool to core infra, and go-to-market muscle is becoming the real edge.

—

The Shifting Venture Landscape

The venture landscape is shifting in two directions at once. On the primary side, deal volumes are down, but round sizes are larger, VCs are placing bigger bets on fewer companies, especially in AI.

On the secondary side, exits are cooling, with IPOs and M&A activity well below recent peaks. It’s tempting to read this as the end of the cycle, but the reality is more nuanced.

Look closer, and a different story emerges. What we’re seeing is not a freeze, but a fundamental reset. The rules of the game have changed, shifting away from the growth-at-any-cost playbook of the past toward a renewed focus on sustainable, fundamentals-first execution.

The monsoon may have slowed traffic but not our portfolio, here’s what Q2 poured in.

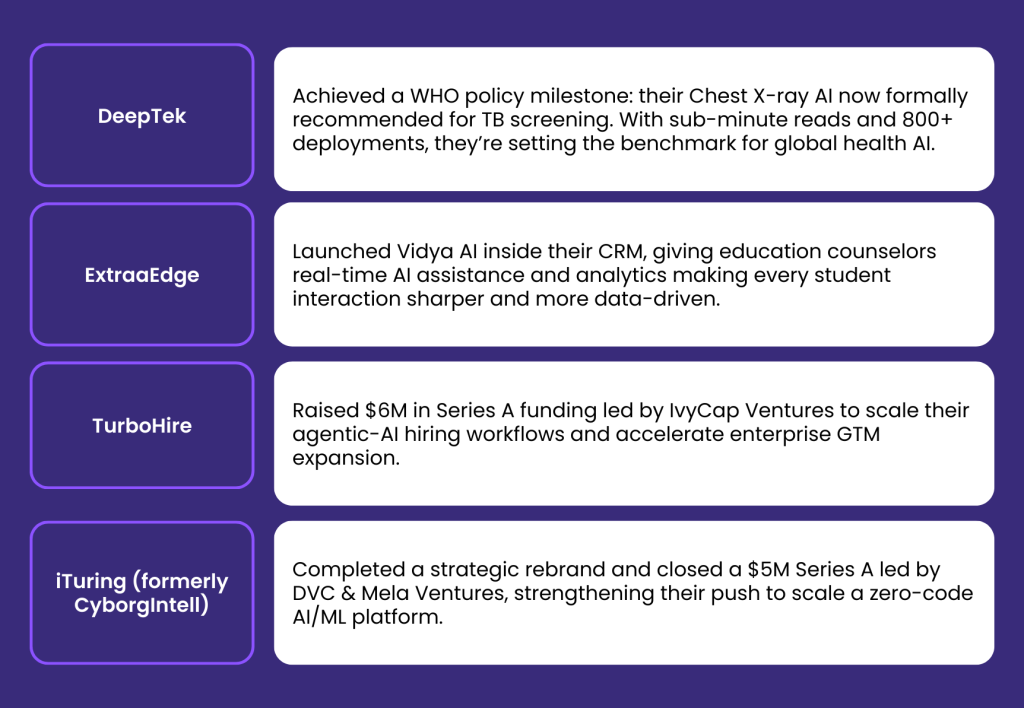

Portfolio Wins

Signals of Scale

Fresh Bets

New Portfolio Additions

600M+ Indians are excluded from both public and private insurance, leaving medical costs funded out-of-pocket or through borrowings. AyushPay provides OPD, diagnostics, pharmacy benefits, and emergency credit via hospitals and NBFC partners.

Healthcare financing is a $40B+ opportunity. AyushPay’s B2B2C model subsidized through provider partnerships makes it inclusive by design, with distribution muscle rooted in hospital networks. This creates both impact and scale.

Unplanned industrial downtime costs $1.5T globally, with manufacturers struggling to detect machine health issues before they escalate. Intellithink combines proprietary sensors with AI analytics to predict failures and cut energy inefficiencies.

Already live in 50+ enterprises (JSW, ArcelorMittal, Adani), it’s showing strong product-market fit. Expansion into the Middle East opens global TAM, and their hardware+AI approach builds defensibility few startups can replicate.

India’s secured lending still takes 7+ days because of manual document checks and compliance-heavy workflows. Neurofin automates doc validation, policy rules, and audit logs cutting timelines to under 24 hours.

It’s tackling a $3B+ market that legacy RPA and loan platforms can’t touch, with domain-trained AI built for BFSI complexity. That wedge, compliance-first automation, has the potential to scale across every secured lending desk in the country.

Our Q2 Lens

Our Big Lens This Quarter: Cybersecurity

The way we think about security has flipped.

The old security walls don’t exist anymore. Today, your APIs, devices, and data are the real entry points. And with AI in play, both attackers and defenders are moving faster than ever.

Legacy tools are cracking under multi-cloud sprawl. The real opportunity lies in cloud-native, API-first security that makes protection invisible but indispensable.

In our thesis, we talk about where durable value is building up from AI-driven detection and developer-first security to Zero Trust infra and unified data protection.

GTMD Insights

Lessons from Founders this Quarter

Vinod Nagarajan (Founder, Revopsly, Ex-Amagi)

Scaling from $500K to $5M is about building a RevOps backbone that keeps growth predictable. Vinod showed how aligning systems, processes, and data early gives founders a real engine for scale.

Saurabh Lahoti (Partner, Pentathlon Ventures) & Vinod Shankar (Partner, Java Capital)

Fundraising gets real when you test your story live. Saurabh and Vinod walked founders through sharpening the “why now” and structuring their pitch so it resonates with investors beyond just numbers.

Aditya Vemuganti (Co-founder, Swipe)

Inbound isn’t about just generating leads. Aditya showed how early SaaS founders can design inbound systems that directly convert into predictable pipeline and revenue growth.

Saurabh Ahuja (CEO, Investment Banking at GTMDialogues) & Pankaj Tripathi (Co-Founder, GTMDialogues)

Scaling inbound needs process and patience. Saurabh and Pankaj walked founders through tying inbound to real revenue outcomes and balancing quick wins with long-term engines like SEO and content.

Want to be in the room next time?

Explore past sessions and upcoming cities

Market in Motion

AI App Margins: From Zero to Something Real

Right now, AI apps look shiny, but most aren’t making much money. Margins at the app layer are razor-thin (–14% to +36% in some cases, like Replit). Meanwhile, infrastructure players are still holding ~70% margins. That gap is telling.

What this means for founders: If you’re building apps, you can’t just rely on growth. The real wins will come from smarter model routing (using the right AI for the right job), adding deterministic features (so customers actually trust outputs), and disciplined pricing.

What this means for investors: Infrastructure is still where the strongest returns are. But that doesn’t mean applications are irrelevant, it just means the winners will be the ones that lock in users through strong distribution and workflows that actually generate margins.What to watch: The next wave of winners won’t be the flashiest AI apps. They’ll be the ones that quietly figure out how to make unit economics work and the infra players that everyone else depends on.

Until Next Quarter

That’s a Wrap (For Now)

Q2 was packed – new wins in the portfolio, sharp debates in GTMD rooms, and research that pushed us to rethink what “defensibility” really means in SaaS and fintech. But if there’s one signal cutting through the noise, it’s this: capital is rewarding execution over experimentation.

We’d love to hear from you.

What did you think of this edition? Anything you’d like us to spotlight next quarter? Your feedback helps us sharpen what we share.

Follow us on LinkedIn for the latest news, founder stories, and insights from across the portfolio.