Positioning your business’s core value proposition is the foundation on which all good startups are built. Through my own experience of co-founding Clarice, a software product development services company, I can vouch for the huge difference that positioning made.

The key differentiating factor for Clarice was design-led innovation. Back then, there were hardly any set-ups where designers and developers worked together under one roof — companies did either product design or development, not both.

Our service offering, led by User Experience Design, was appreciated by many CXOs, who believed engaging with us would make a big difference to their products.

I’m a firm believer in good positioning. But what are the nuances in getting it right?

What is product positioning (and what it is not)

The biggest misconception about product positioning is that it’s often mistaken for good marketing. In reality, product positioning begins a few steps earlier, as a cross-functional exercise between the product development and other teams. It’s an exercise that determines the product or service you end up offering.

It’s not how different you look using marketing — it’s about defining your product’s unique value, and carving that space in the mind of your customer.

Another good example of this comes from outside tech. Consider the case of Tim Hortons and Starbucks. Most of us know of Tim Hortons as the ‘Canadian Starbucks’. But to the Canadians, it just…. Tim’s, the neighbourhood coffee shop.

The crucial difference was their product positioning. Starbucks has a tinge of the aspirational — what with their endlessly customisable menus with Pumpkin Spice Lattes and Caramel Frappuccinos.

Tim Hortons just made it about the coffee, reflected in their slogan: “Always Fresh”. Their food follows the same principle and appeals to the Canadian palate (timbits, a type of small doughnut, are the signature food item at the restaurant chain).

This unique product positioning is reflected in the sales of Tim’s in Canada, which was nearly six times that of Starbucks in 2018, even 30 years after Starbucks’ entry in Canada.

Great positioning examples from SaaS

Examining value in context and use case

Most entrepreneurs believe in the intrinsic value of their product. But this isn’t always apparent to everyone else. Setting up a business video calling software, sales automation services, or even Instant Messaging seem like no-brainers. But the current market leader in each space used context or circumstance to get ahead.

(Remember BBM messenger? It led the market for users until 2014, when its exclusivity to Blackberry users became its downfall.)

One such obvious “utility” today is cloud computing. When Rackspace first entered the crowded cloud computing space, they understood that businesses weren’t just looking for infrastructure — they were also looking for managed services.

So Rackspace’s “fanatical support” (what they chose to call their impeccable customer service) became an integral part of their product positioning. That’s what allowed for their phenomenal growth. That was until AWS came along with a positioning that captured another rising need — dynamic pricing and customisation.

Figuring out the problem you are solving with your product is a good space to start. But the context in which you offer your services can be a key differentiator.

What problems are you solving?

Your product positioning also depends on what customer problems you are solving. It’s important to position your product for value — this only comes when you have a deep understanding of the market and its pain points.

In my experience, companies are willing to pay a premium for the right value proposition. (Managed services, strong cybersecurity and on-call customer support are some factors that attract top dollar)

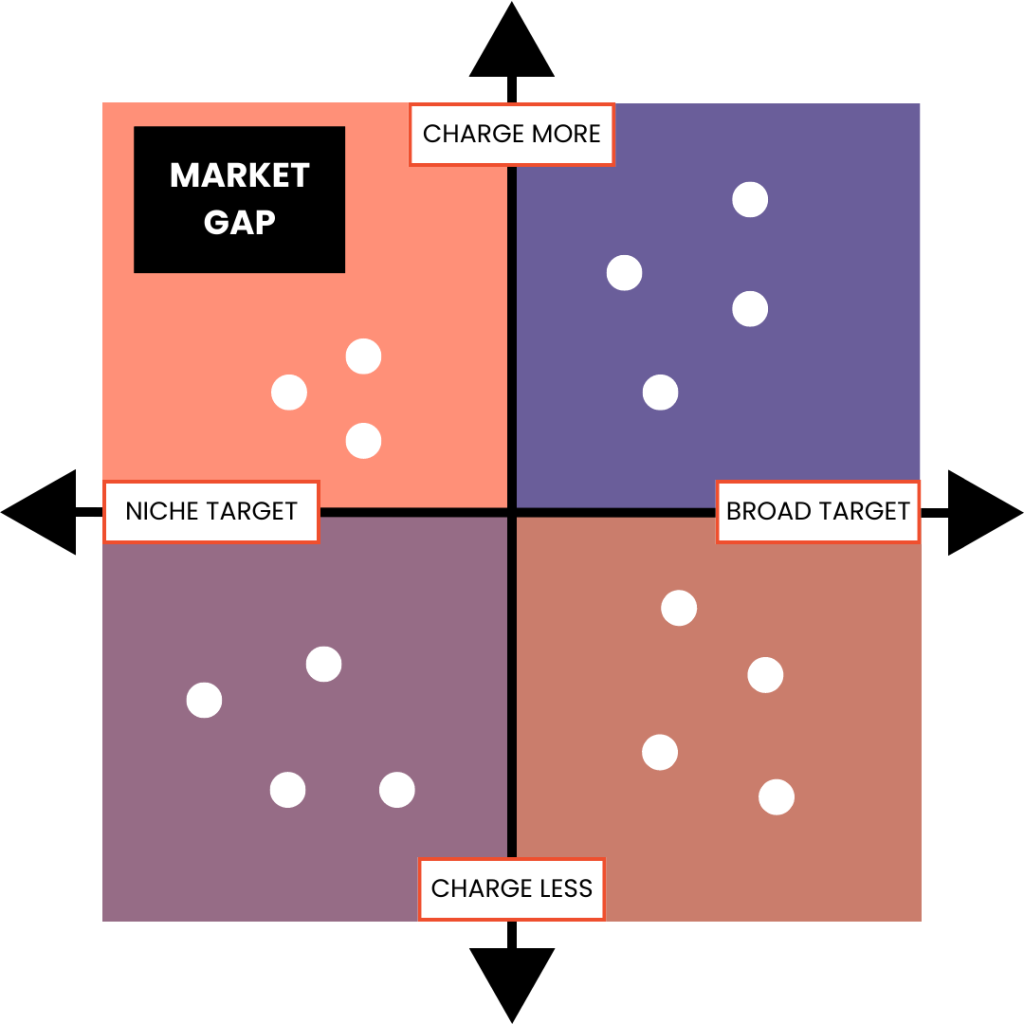

The other key to product positioning is where you fit into the existing market.

ExtraaEdge, one of our portfolio companies, works exclusively with educational brands & institutes. Abhishek Ballabh, the founder, says they don’t call themselves a CRM. They position Extraaedge as a Revenue Operations (RevOps) platform. “We are helping educational brands scale their sales and marketing effort with our CRM and marketing automation,” he says.

So while ExtraaEdge works as a Sales Operating Systemfor education sales reps & admission counsellors, it is equally a marketing software for educational brands & institutions! This is a great example of a nicely positioned product that has differentiated itself in a competetive market.

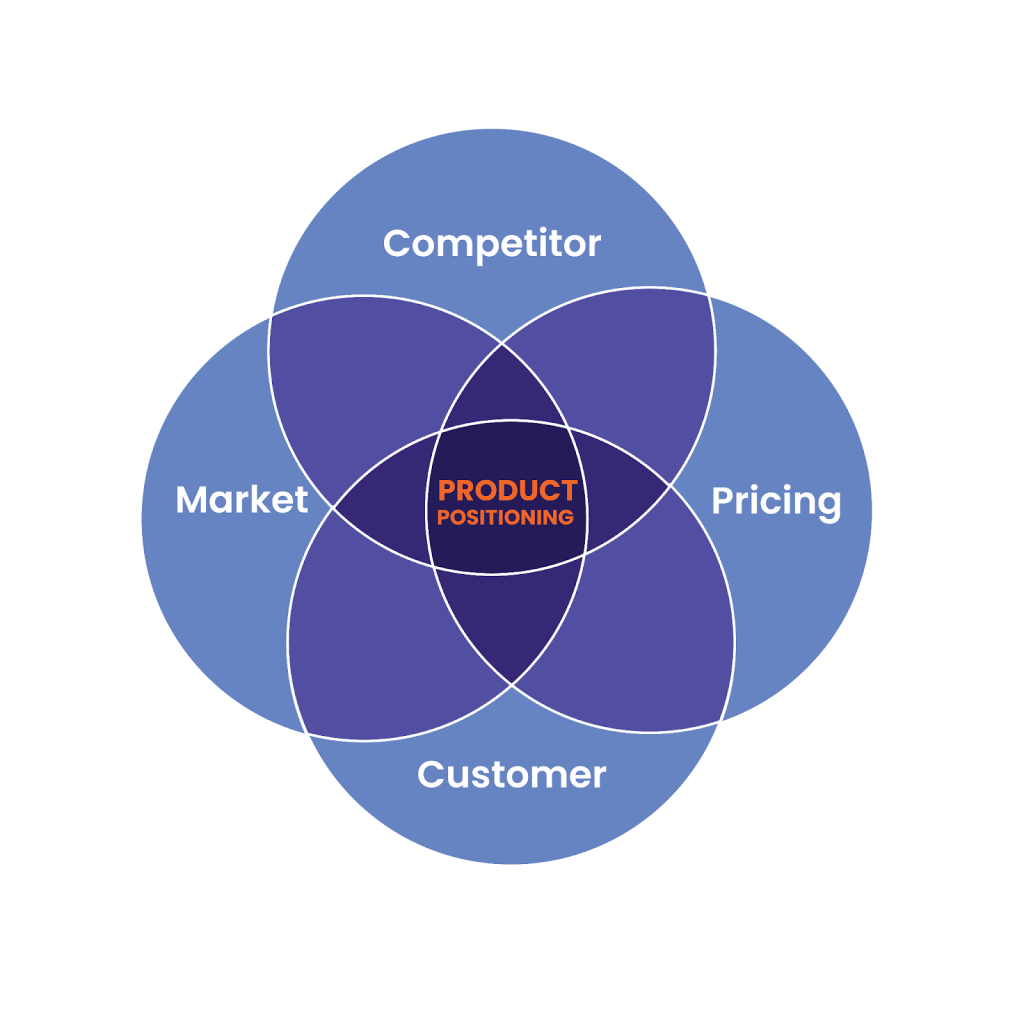

That said, there’s four main avenues through which effective product positioning takes place:

Customer → Competitor → Pricing → Market

The Customer

Case 1

Tripeur, one of Pentathlon’s portfolio companies, is focused on corporate travel bookings. They built the product with the average corporate employee as an end user. But during the pandemic, they expanded the understanding of their customers. Paying attention and easing the pains of the admin team of their customers, for instance, gave them better insights into their own product. It helped add new features like GST processing.

Case 2

CyborgIntell is an enterprise AI startup that provides AI solutions for financial services. Their flagship product, “iTuring,” is a ‘No-Code’ AI-powered data science and machine learning software that helps enterprises develop, deploy, operationalise, and manage machine learning models on a single platform.

Initially a “platform services” company, CyborgIntell began offering plug-and-play solutions for specific use cases in the BFSI sector.

Suman Singh, the Founder of CyborgIntell says use cases allowed them to better convince clients about the business benefits of their product — things like pre-issuance risk verification for life insurance, claim risk assessment and decisioning for health insurance, fully automated creditworthiness checks and loan decisioning, and reducing customer acquisition costs.

The decision to offer these plug-and-play solutions was driven by the company’s understanding of their customers’ needs and limitations.

“Banks might be early innovators, but they are also the first to cut spending at the sign of trouble,” Suman says. “But with the recession, spending on automation solutions typically increases, which we [CyborgIntell] feel poised to make use of.”

Competitor

“The first guy through the wall, he always gets bloody. Always” – Moneyball, 2011

The competitor is the great phantom of the SaaS world, to be spoken of in hushed tones. But objectively speaking, the competitor is a great validator for a concept. When a competitor exists, it means your concept has takers.

The next step then is to create a niche.

Case 1:

There were a number of alternatives to Zoom in the market until recently: WebX, GoTo Meeting, Skype. Skype’s growth in 2004 – 2005, from 10 million to 60 million users has few parallels in the history of SaaS products. Skype’s main USP at the time was that its computer-to-computer calls were free; and you could make long-distance international calls at a fraction of the cost of regular phone calls.

But when the pandemic made video conferencing tools absolutely necessary, Zoom shot up to the top of the market.

Put simply, Skype failed because it was essentially a chat messenger with a (some would say buggy) video calling feature. And Zoom’s founder (who was a founding engineer on Cisco’s Webex platform) had focused on user experience from the start.

Then there were the features that came as a godsend while working from home — blurring the background, an option to record meetings, mobile to desktop interoperability.

And unlike its competitors, Zoom is a high-quality video conferencing tool on a freemium model, with reasonable rates for individuals. Essentially, Zoom was shaped by the spaces its competitors left around it — and that’s what allowed it to get ahead of others.

Case 2:

When Extraaedge was first entering the education space, they understood that admission counsellors were their primary users. So they built a single-page, mobile-first, offline platform with great ease of use for education administrators.

And while other competing Marketing automation or CRM platforms offered a greater breadth of services, it also meant a lot of complexity.

Extraaedge, in turn, offered a customised, end-to-end solution that simplified the marketing and sales cycle of educational institutions. So while other platforms take their time with integrating WhatsApp for their clients, for instance, Extraaedge is able to do it in a day or two.

Again, looking at the spaces left by all-purpose CRM or marketing automation services has allowed Extraaedge to capture their own niche.

Price

Price is important in product positioning, but is ultimately a sub-set for the value you create. The winning strategy is good value delivered at the right price.

The most common pricing strategies are “usage-based pricing” (where you charge for services used), “feature-based pricing” (where you charge for features they use) or “outcome-based pricing” where you charge based on results achieved.

Case 1:

Mogi I/O started off with video delivery-related technology, essentially allowing their customers to set up OTT platforms. Initially, they only focused on delivering their services to enterprise clients. Though the proposition was lucrative, the sales cycle was long.

Earlier this year, they focused on the Small and Mid-size Business (SMB) segment of content creators. The innovation they made here was to offer flexible pricing for subscriptions. The big difference? Setting up a “prepaid” model for SMB users, where they could carry forward the service until it was used and needed to be “topped up”

Where the subscription model works for bigger clients with a fixed set of users, the “Pay as you go” model works for SMB creators who might be unwilling to commit to a monthly subscription. Figuring out the right mix of value and pricing can be key to getting your product positioning right.

Market

Here’s some market factors that feature into product positioning. It’s easy to overestimate the Total Addressable market for any product. But aligning your product with the Service Available Market (SAM) or Service Obtainable Market (SOM) is an important part of product positioning.

Case 1:

DeepTek, another one of our portfolio companies, has a very niche use case — they are an AI-powered Medical imaging tech, started primarily with chest X-rays.

In the health space, Deeptek found their SAM (AI-powered medical technology) was lucrative enough. Within medical imaging technology, they opted for X-rays, which forms the highest volume of cases and is the least preferred task for radiologists. Chest X-rays also accounted for nearly 60% of all tests done.

But above all, they built their product with an eye to the future. As the need for medical services grows in developing countries, the need for medical imaging tech is only bound to increase. So Deeptek is betting on its SAM increasing in the coming years.

In conclusion

All things said, it could take a while before organisations arrive at a product positioning strategy that works for them. Even when you go through various iterations, it’s important to remember the importance of consistent effort. As Al Ries, the late American author who wrote the definitive book on product positioning said: “Successful positioning requires consistency. You must keep at it year after year.”

Until next time,